Elevate your travel to new heights and enjoy exclusive privileges and benefits as you discover Thailand with a Thailand Elite Privilege Visa. At Thailand Elite Privilege Visa by Hawryluk Legal Advisors, we assist you in obtaining a long-term tourist visa, enabling you to reside in Thailand for 5 to 20 years.

What is Thailand Elite Privilege Visa?

Thailand Elite Privilege Visa is a long-term tourist visa that grants members VIP benefits. This privilege entry visa program presents a selection of visa packages for foreigners, spanning 5 to 20 years, each offering various privileges.

The program is a legal membership program designed by the Thailand Privilege Card Co. Ltd. to make VIP facilities, privileges, and other perks for an extended, hassle-free stay available for guests invested in Thailand or on a permanent vacation.

The Thailand Elite Privilege membership program offers a streamlined process for travelers and international investors to enter Thailand, bypassing the bureaucracy commonly associated with visa applications.

The program aims to encourage more visitors to explore Thailand, support the country’s thriving tourism industry, and attract international capital for economic growth. This makes the Thailand Elite Privilege Visa an ideal choice for those who wish to experience a hassle-free, long-term stay in the country.

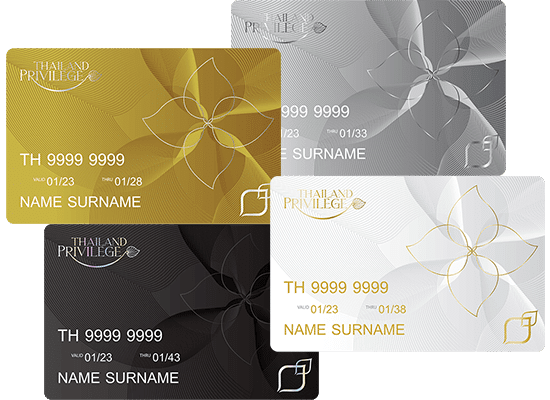

Anyone legally qualified to enter Thailand can sign up for membership and acquire a Thailand Elite Privilege Visa! Applicants may choose from one of several Elite Privilege Cards here.

Who Are Qualified to Become a Member?

Having a Thailand Elite Privilege Visa allows you to come and have a long-term stay in the country without dealing with expenses associated with going back and forth travel. This program welcomes all foreigners who want to visit and stay in Thailand. All applications will be approved within 45 days.

The membership benefits are ideal for:

- Retirees

- Digital nomads

- Tourists

- Business professionals

- Investors eyeing opportunities in Thailand

- Families relocating to Thailand

- Martial arts enthusiasts

- Those considering Thailand as a second home

What Are the Benefits?

The following summarizes the benefits that full members of the program can enjoy. Bear in mind that the actual benefits may differ according to the type of membership you choose.

- Access to exclusive airport departure and arrival lounges.

- Exclusive immigration lanes for fast arrival and departure.

- VIP pick-up and transfer from the airport to your hotel via limousine and vice versa.

- Assistance in government transactions, including the 90-day driver’s license filing and processing.

- Assistance in processing bank accounts with local currency.

- Elite Personal Assistants are available to assist you with any activities or questions you may have while in Thailand.

- Receive discounts at participating establishments, including the King Power duty-free store.

- Exclusive add-ons to spa, culinary, and golf course amenities.

- Complementary health examination.

… and more!

Why choose us for your Thailand Elite Privilege Visa?

Hawryluk Legal Advisors, licensed by Thailand Privilege Card Co. Ltd, ensures your Thailand Elite Privilege Visa application is managed by expert immigration lawyers. We streamline your application process, targeting approvals within 4 to 6 weeks. Affixing your visa can be done at any of the following locations:

- Upon arrival at Bangkok’s Suvarnabhumi Airport

- Upon arrival at Phuket International Airport

- Chaeng Wattana Immigration Office or

- Local Thai Embassy in Your resident country

We have won numerous awards, including Thailand Elite’s Rising Star Award.

With a Thailand Elite Privilege Visa, you can explore Thailand’s beauty while enjoying exclusive Elite member benefits. Here’s what you gain:

- Avoid long lines for government tasks by hiring an Elite Personal Assistant. They can handle tasks like your 90-day report, given you provide the needed documents, costing only 1 Privilege Point.

- Save THB10,000 every 90 days (or THB40,000 annually) that would otherwise be spent on border runs.

- Enjoy a hassle-free stay without frequent visa extensions or paperwork. This long-term visa ensures a deep connection with Thailand, whether for work, relaxation, or cultural engagement.

- Experience premium, faster immigration processes, skipping long lines and delays.

The Thailand Elite Privilege Visa offers unparalleled convenience and exclusive perks, enhancing your Thailand journey. Start your elite travel experience by becoming a member today!

Choose A Membership That's

Right For You!

Welcome To A

World Of Privileges

The Team

Why Hawryluk Legal Advisors?

On September 18, 2014, Thailand Privilege Card Company Limited (TPC) appointed Hawryluk Legal Advisors as an Authorized General Sales and Services Agent to promote their Thailand Elite membership programs.

With a local office in Phuket, Thailand, our experienced team is best placed to guide you through the process of acquiring a Thai Elite card. We will be there for you throughout the application process and assist you with the submission of required documentation.

You can also send inquiries and questions about Thailand Elite Visa through our 24/7 live chat.

For more info, visit https://www.hawryluklegal.com/.

View All Memberships

View All Memberships

Meet The Team

Meet The Team