LIMITED OFFER: Add family for just THB 500K under Platinum, Diamond, or Reserve tiers - offer ends Sept 30.

Apply now.

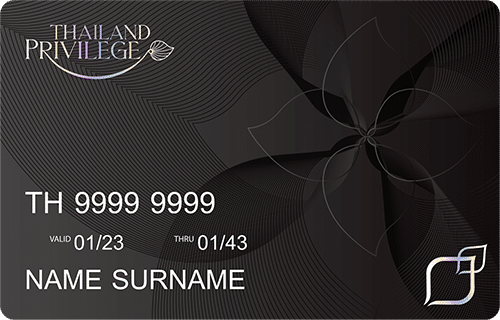

Thailand Privilege Membership Packages

Thailand Privilege Card, formerly known as Thailand Elite Visa falls under the Tourist Visa category (Privilege Entry Visa “PE”) and offers numerous benefits and services for its members. Our commitment is to provide you with expert guidance and support, ensuring a smooth and hassle-free stay in Thailand.

Our membership packages offer a range of visa options designed to cater to your unique needs.

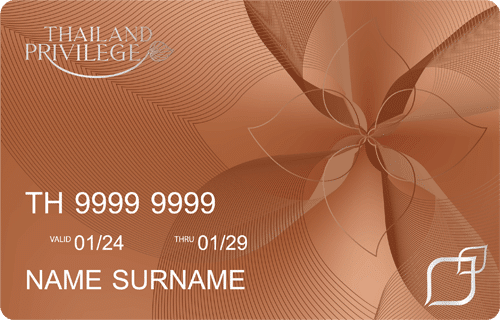

The Bronze Membership serves as your entry point to foundational privileges, inviting you to start your luxury travel experience in Thailand.

- 5 Years Visa validity

- 650,000 THB membership fee

- Membership can’t be transferred

- Upgradeable

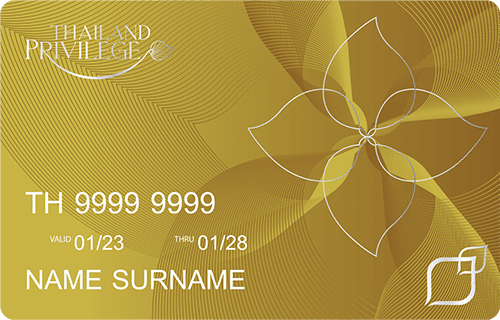

The Gold Membership is uniquely designed for individuals seeking a refined living experience in Thailand.

- 5 Years Visa validity

- 900,000 THB membership fee

- Membership can’t be transferred

- Upgradeable

- 20 Privilege Points/Year

Step into a world of expanded opportunities and enriched experiences with the Platinum Membership.

- 10 Years Visa validity

- 1,500,000 THB membership fee

- Membership can’t be transferred

Additional 1,000,000 THB membership fee per member- Limited-time: Add a family member for 500,000 THB (until Sept 30 only)

- Upgradeable

- 35 Privilege Points/Year

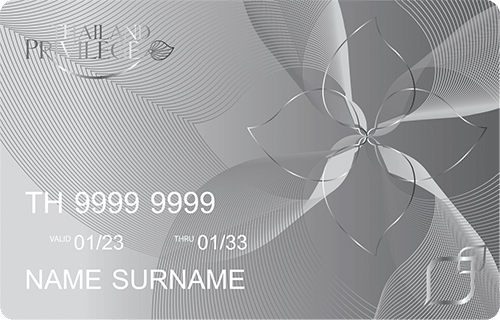

Experience a redefined life with the Diamond Membership, promising extended enjoyment and luxury living in Thailand.

- 15 Years Visa validity

- 2,500,000 THB membership fee

- Membership can’t be transferred

Additional 1,500,000 additional membership fee per member- Limited-time: Add a family member for 500,000 THB (until Sept 30 only)

- Upgradeable

- 55 Privilege Points/Year

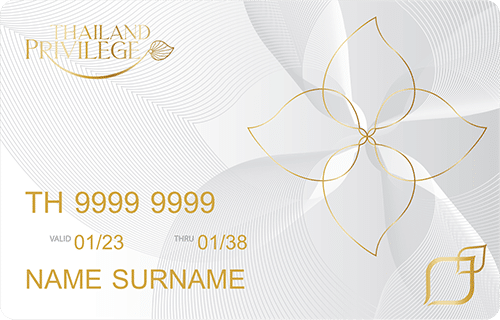

Our most exclusive package that grants you the freedom of choice and opens the door to endless privileges.

- 20 Years Visa validity

- 5,000,000 THB membership fee

- Membership can be transferred

Additional 2,000,000 THB membership fee per member.- Limited-time: Add a family member for 500,000 THB (until Sept 30 only)

- Non-Upgradeable

- 120 Privilege Points/Year

Thailand Privilege Members have access to exclusive perks and benefits. These include liaison and assistance via the Elite Personal Assistant service on arrival and departure. The Elite Personal Liaison service also lets you delegate certain tasks like government and bank transactions to someone else as a proxy.

There are also complimentary services in spas, golf courses, restaurants, and limousine transfers to and from your hotel. Here are the different privileges you can enjoy with your Thailand Privilege membership.

Please call us or fill out the contact form below if you have any questions or if you want to know more about your privileges. We’ll be more than happy to accommodate you.

Very friendly professional and helpful staff. They explained every step and were always available any time I had questions.

![Scott Serres]()

Scott Serres

I obtained my Thai Elite Visa right when Covid hit and I could not leave the country in which I work for visits to Thailand. However, the wonderful staff at Thai Elite have kept me informed constantly about changes to entrance requirements and all of the changes to services they provide. It has been a tremendous help and comfort and now, at the end of 2022, I will retire and be able to start my journey to Thailand. Thanks to everyone at Thai Elite Visa!

![Clocktower Hill]()

Clocktower Hill

So we took the plunge and decided to move to Thailand and with Michelle’s knowledge and guidance we decided on the Elite Visa. They were fast and efficient in answering our residency questions and best thing is that there were no hidden costs, no appointment and all was in English. Thank you for your help.

![Andre Glover]()

Andre Glover

Hawryluk Legal took all the guess work out of deciding which Elite Visa was best for my circumstances. I went directly to their offices and had all my answers before I left…in English! Feeling much more confident about my Elite Visa decision.

![Melinda McManus]()

Melinda McManus